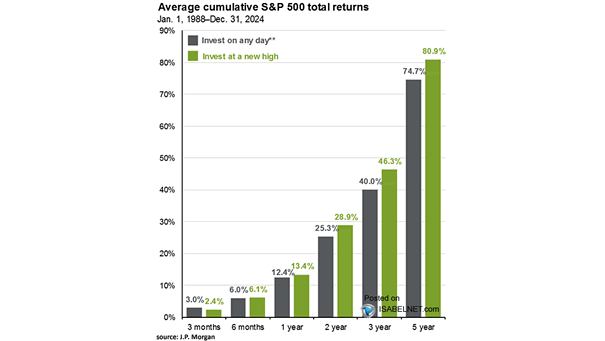

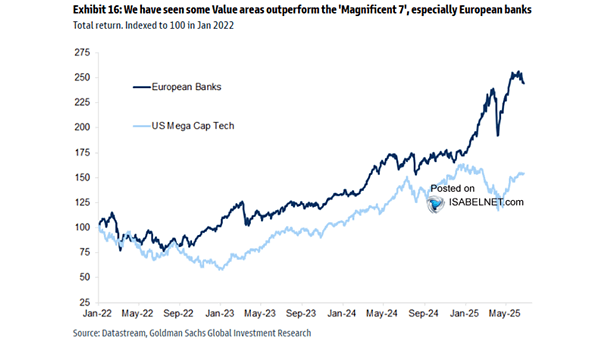

Average Cumulative S&P 500 Total Returns – Invest on Any Day vs. Invest at a New High

Average Cumulative S&P 500 Total Returns – Invest on Any Day vs. Invest at a New High While many are skeptical about investing at all-time highs, evidence suggests it often leads to stronger forward returns compared to investing at random days. Image: J.P. Morgan Asset Management