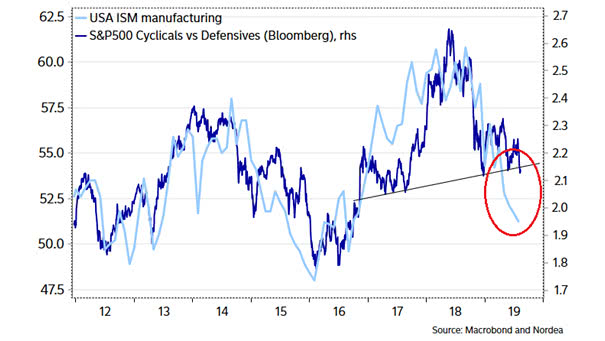

ISM Manufacturing Index and S&P 500 Cyclicals vs. Defensives

ISM Manufacturing Index and S&P 500 Cyclicals vs. Defensives This chart shows the nice correlation between ISM Manufacturing Index and S&P 500 Cyclicals vs. Defensives. Image: Nordea and Macrobond