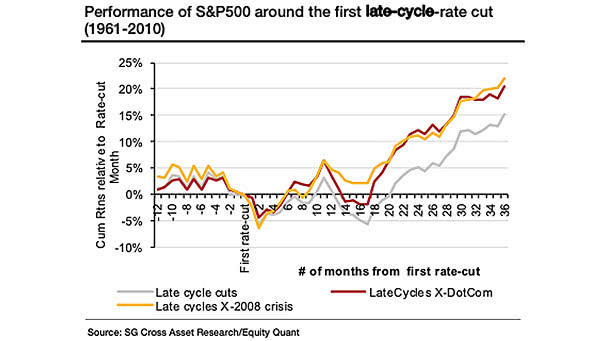

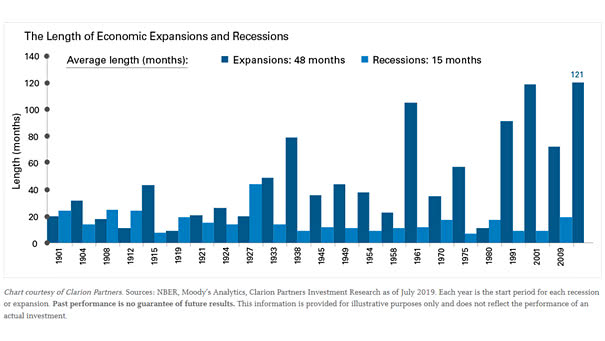

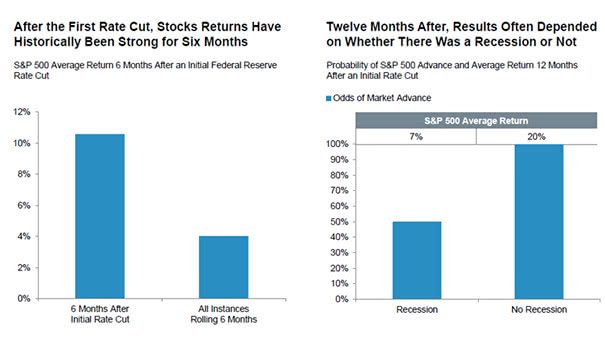

Performance of S&P 500 Around the First Late-Cycle Rate Cut

Performance of S&P 500 Around the First Late-Cycle Rate Cut After the first-rate late-cycle cut, the S&P 500’s performance is generally not exceptional. Image: Societe Generale Cross Asset Research