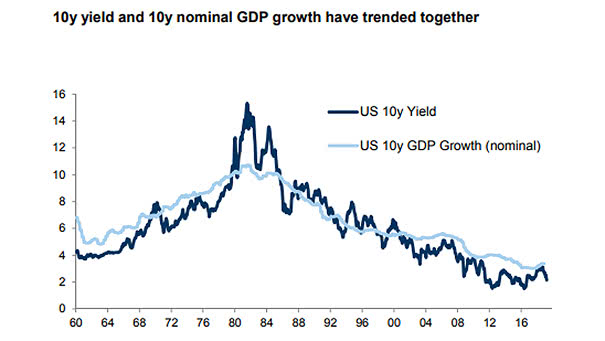

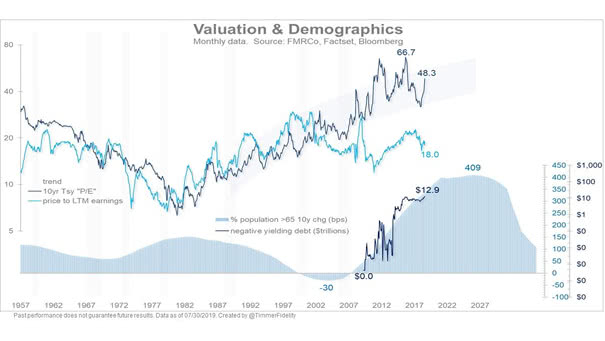

U.S. 10-Year Treasury Bond Yield and U.S. 10-Year Nominal GDP

U.S. 10-Year Treasury Bond Yield and U.S. 10-Year Nominal GDP The long-term trend in U.S. nominal GDP growth is a good indicator of U.S. nominal bond yields. Image: Goldman Sachs Global Investment Research