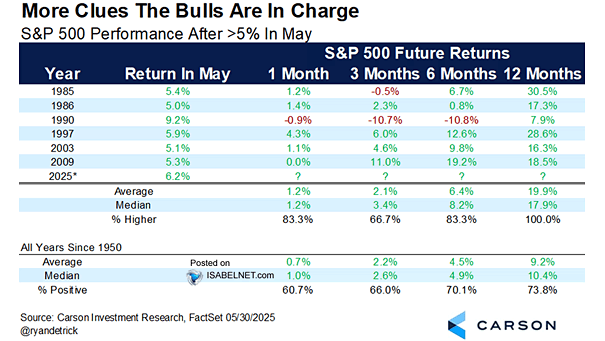

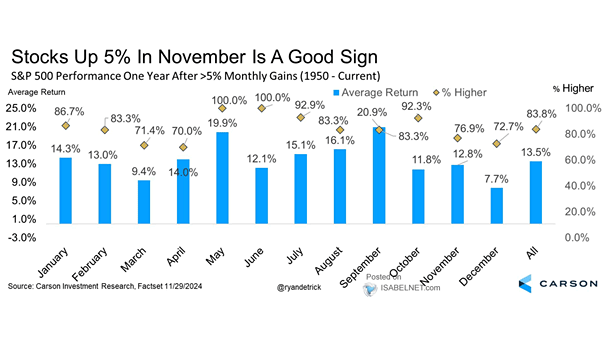

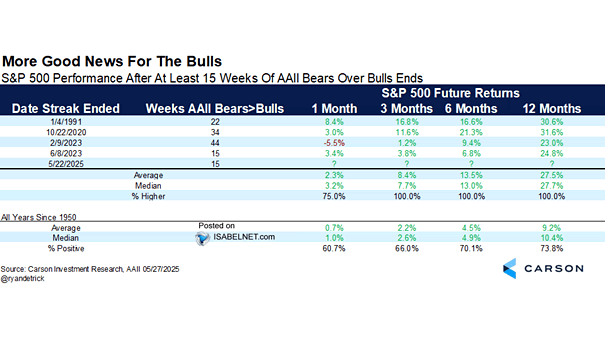

S&P 500 After 5% Gain In May

S&P 500 After 5% Gain In May Historically, when May delivers a gain of over 5%, June tends to see continued strength, and the following 12 months have always produced positive returns, averaging close to 20% since 1985. Image: Carson Investment Research