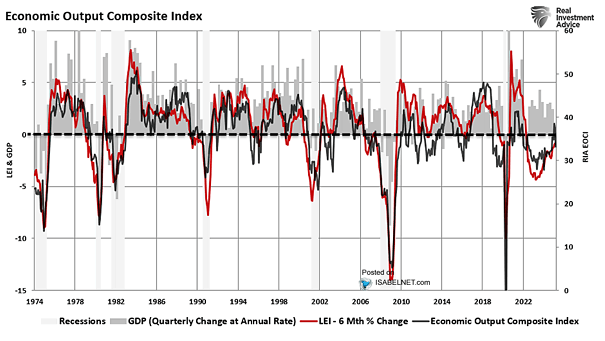

Recession – Economic Output Composite Index vs. LEI

Recession – Economic Output Composite Index vs. LEI With the Economic Output Composite Index in expansionary territory, the likelihood of a recession in the U.S. appears low for now. Image: Real Investment Advice