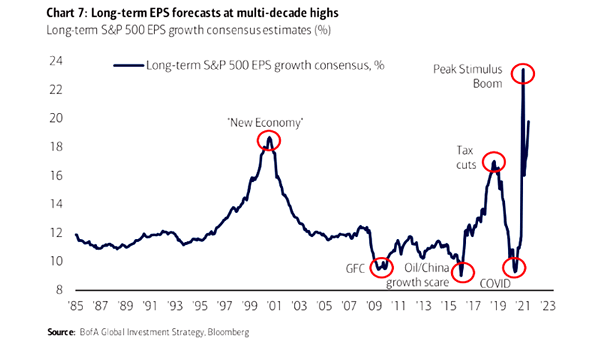

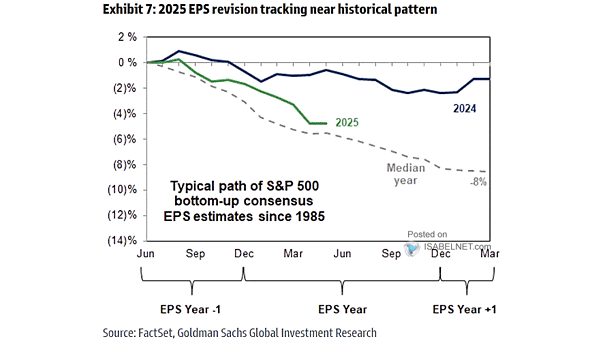

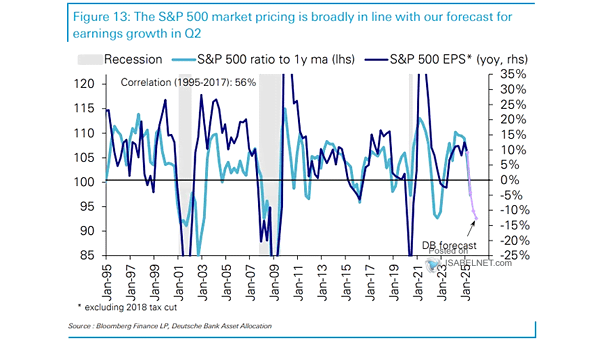

Consensus EPS Growth Estimate

Consensus EPS Growth Estimate Following the initial Magnificent Seven earnings report on April 22, analysts revised full-year earnings estimates upward by 1.8% for the Magnificent Seven, but downward by 0.8% for the other 493 companies in the S&P 500. Image: J.P. Morgan Asset Management