Why Are Dividends and Buybacks Hitting Record Highs?

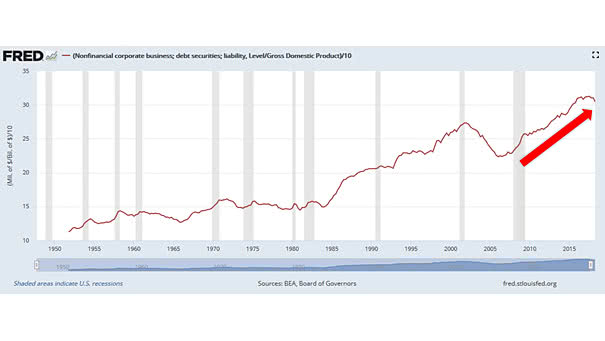

Why Are Dividends and Buybacks Hitting Record Highs? Corporate stock buybacks and dividends are booming, thanks to the tax cuts and low interest rates.Unfortunately, artificially low interest rates are associated with unnecessary debt and a rise of corporate debt-to-GDP since the Great Recession.