Does Berkshire Hathaway Still Have a Market-Beating Advantage Over the Long Run?

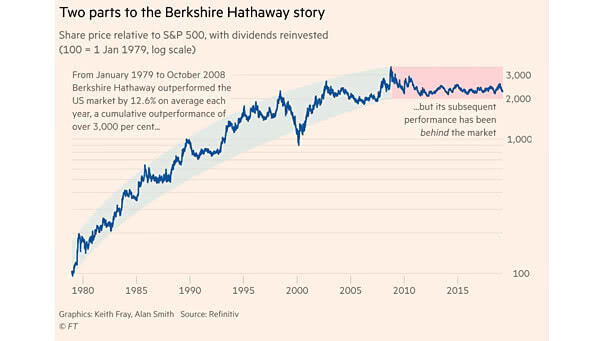

Does Berkshire Hathaway Still Have a Market-Beating Advantage Over the Long Run? We can ask ourselves if Berkshire Hathaway does still have a market-beating advantage over the long run, because Warren Buffett expects a very modest outperformance vs. the market over the next decade. But he can’t guarantee that, of course. Image: Financial Times