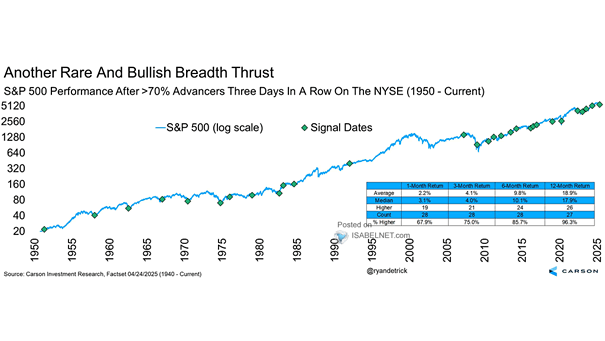

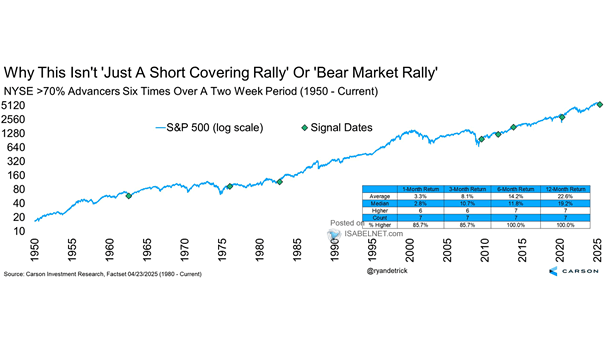

S&P 500 Performance After >70% Advancers Three Days in a Row on the NYSE

S&P 500 Performance After >70% Advancers Three Days in a Row on the NYSE Historically, three consecutive days with over 70% NYSE advancers signal strong bullish momentum. Since 1950, the S&P 500 has delivered positive 12-month returns 96% of the time, averaging an 18.9% gain. Image: Carson Investment Research