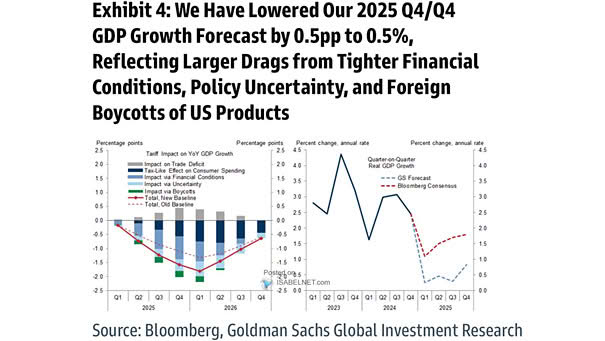

Impact on U.S. YoY Real GDP Growth

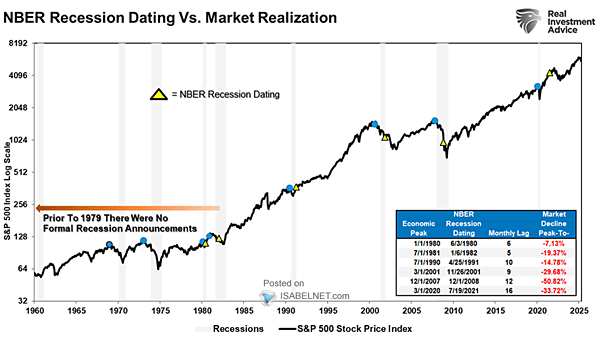

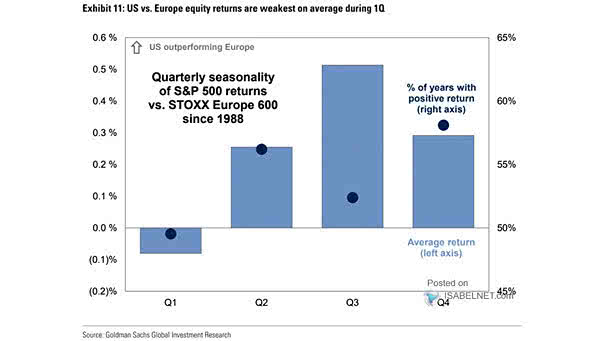

Impact on U.S. YoY Real GDP Growth Goldman Sachs has cut its 2025 Q4/Q4 GDP growth forecast to 0.5% and raised its 12-month recession probability from 35% to 45%, citing tighter financial conditions, foreign consumer boycotts, and heightened policy uncertainty. Image: Goldman Sachs Global Investment Research