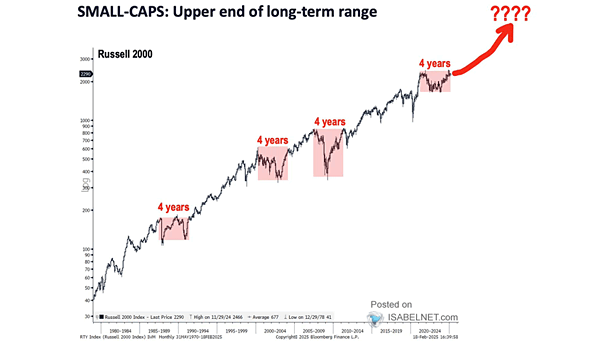

Small-Caps: Upper End of Long-Term Range

Small-Caps: Upper End of Long-Term Range The combination of historical patterns, attractive valuations, and positive earnings growth forecasts suggests that U.S. small-caps may be well-positioned for a period of outperformance in the near future. Image: Fundstrat Global Advisors, LLC