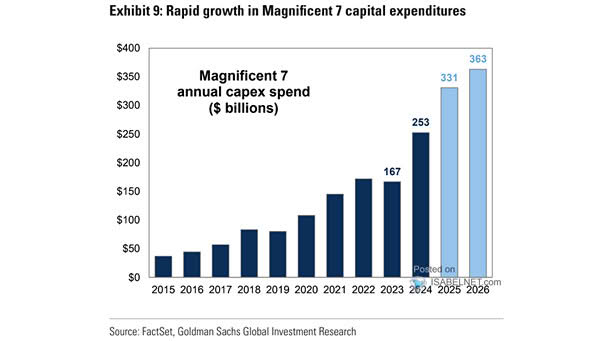

Magnificent 7 Annual Capex Spend

Magnificent 7 Annual Capex Spend The Magnificent 7’s capital expenditure is projected to grow by 31% to $331 billion in 2025, followed by a 10% increase to $363 billion in 2026, underscoring the Magnificent 7’s focus on long-term growth and innovation. Image: Goldman Sachs Global Investment Research