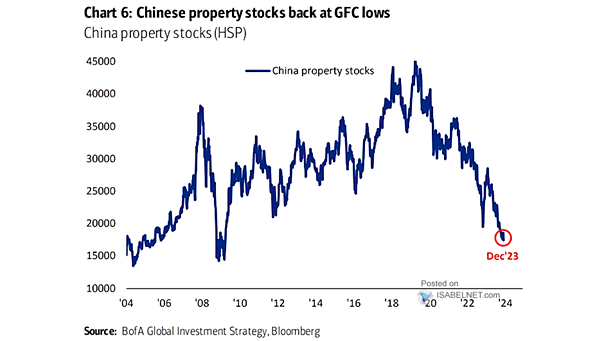

China Property Stocks

China Property Stocks The sharp decline in Chinese property stocks, reaching levels unseen since the Global Financial Crisis, is worrisome considering the crucial role of the real estate sector in China’s economy. Image: BofA Global Investment Strategy