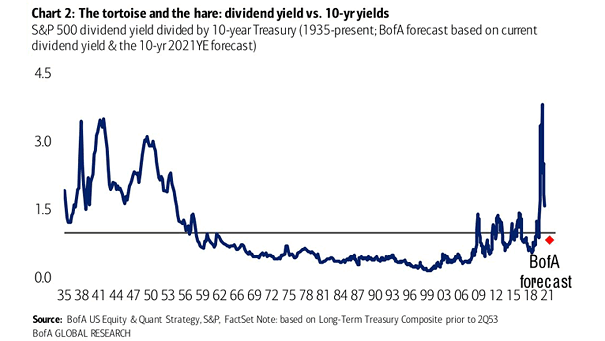

S&P 500 Dividend Yield Divided by 10-Year Treasury

S&P 500 Dividend Yield Divided by 10-Year Treasury The S&P 500 dividend yield could be less attractive relative to the 10-year Treasury, if the 10-year yield rises to 1.75% by year-end. Image: BofA US Equity & Quant Strategy