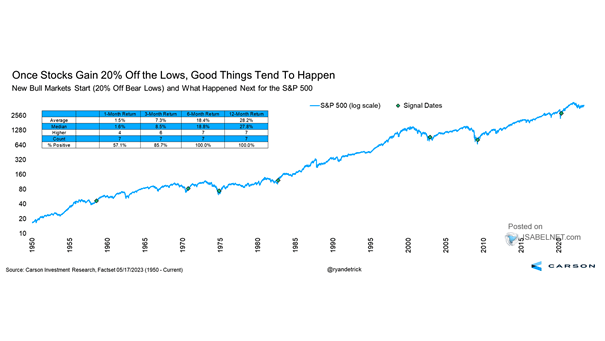

New Bull Markets Start (20% Off Bear Lows) and What Happened Next for the S&P 500

New Bull Markets Start (20% Off Bear Lows) and What Happened Next for the S&P 500 Historically, positive outcomes have typically occurred over the next 12 months once U.S. stocks gain 20% off bear lows. Image: Carson Investment Research