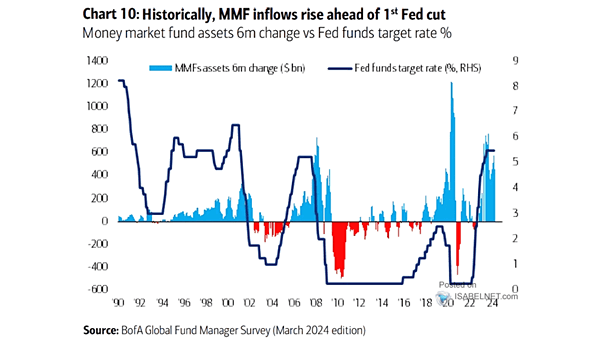

Money Market Fund Assets vs. Fed Funds Target Rate

Money Market Fund Assets vs. Fed Funds Target Rate Money market funds often experience outflows 12 months after the initial rate cut. This occurs as investors reallocate their investments and adjust their risk exposure in response to fluctuations in interest rates and market conditions. Image: BofA Global Fund Manager Survey