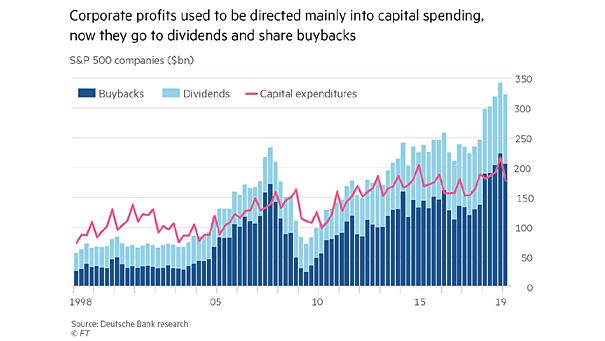

U.S. Corporate Profits, Capital Expenditures, Dividends and Buybacks

U.S. Corporate Profits, Capital Expenditures, Dividends and Buybacks What would happen if U.S. companies reinvested instead of buying their own shares and paying dividends? Image: Financial Times