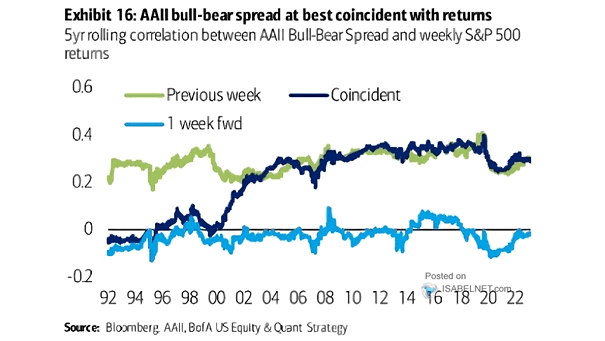

Correlation Between AAII Bull-Bear Spread and S&P 500 Returns

Correlation Between AAII Bull-Bear Spread and S&P 500 Returns The AAII bull-bear spread may not necessarily be a reliable predictor of future S&P 500 returns. Image: BofA US Equity & Quant Strategy