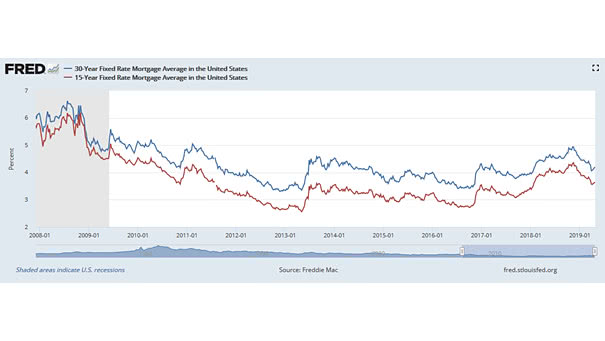

What Are the Average Interest Rates for Fixed-Rate Mortgages Since the Great Recession?

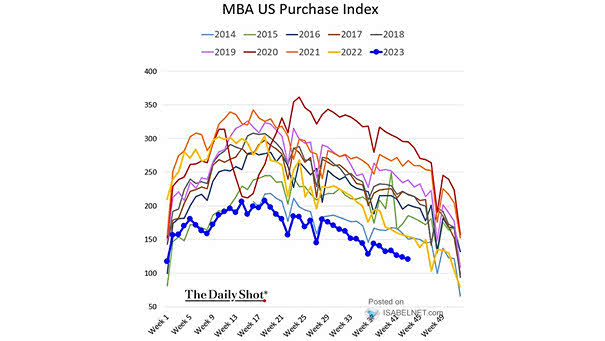

What are the Average Interest Rates for Fixed-Rate Mortgages Since the Great Recession? Keep in mind that mortgage lending is down, because there aren’t enough houses on the market to meet demand and the increase in rates does not help either since 2017. However, the decline in interest rates since the end of 2018, helps…