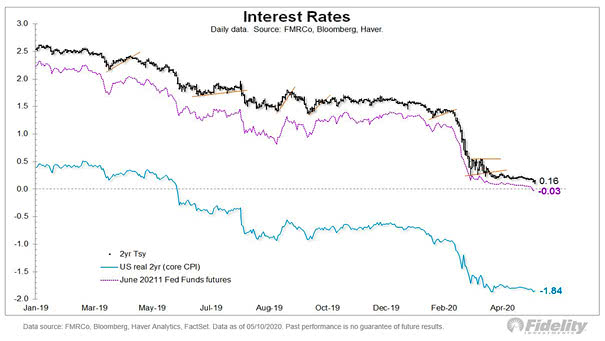

Expected Fed Funds Rate, Negative Interest Rates and 2-Year Treasury Yield

Expected Fed Funds Rate, Negative Interest Rates and 2-Year Treasury Yield Negative U.S. yields are in sight, as Fed funds futures for June 2021 imply an expected negative rate of -0.03%. Image: Fidelity Investments