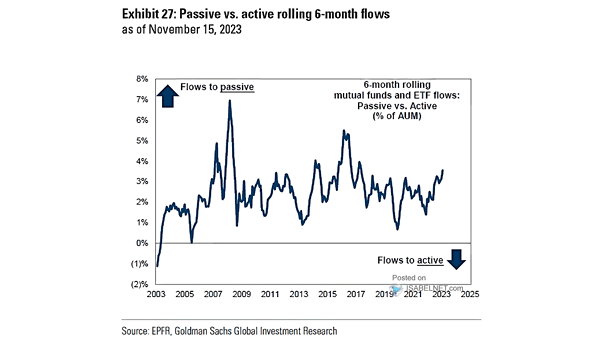

Passive vs. Active Rolling 6-Month Flows

Passive vs. Active Rolling 6-Month Flows Flows into passive mutual funds and ETFs continue to surpass those into active funds. This trend is driven by factors such as lower costs, strong performance, and the rise of ETFs. Image: Goldman Sachs Global Investment Research