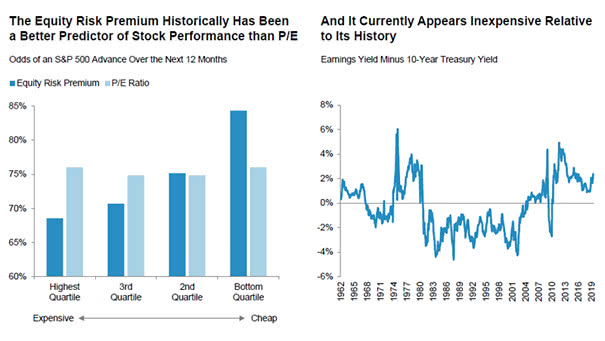

The Equity Risk Premium May Be Bullish

The Equity Risk Premium May Be Bullish The equity risk premium suggests that the S&P 500 is not overvalued, which may be a bullish signal. You may also like our “Stock Market Equity Risk Premium.” Image: Fidelity Management and Research