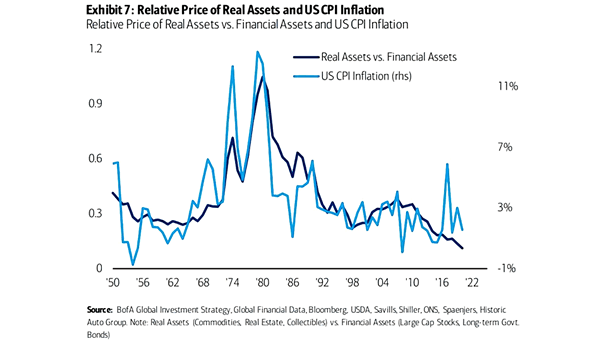

Relative Price of Real Assets vs. Financial Assets and U.S. CPI Inflation

Relative Price of Real Assets vs. Financial Assets and U.S. CPI Inflation Real assets tend to move in line with inflation and generally performs well in inflationary environments. Image: BofA Global Investment Strategy