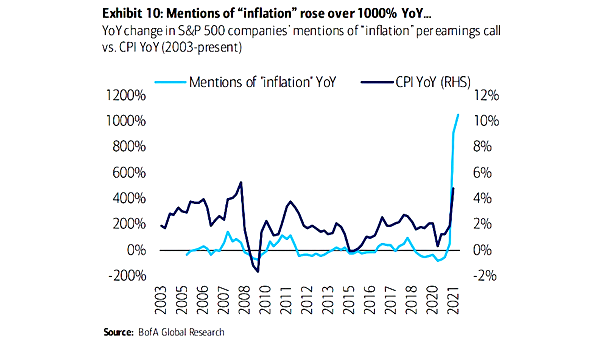

YoY Change in S&P 500 Companies’ Mentions of “Inflation” Per Earnings Call vs. CPI YoY

YoY Change in S&P 500 Companies’ Mentions of “Inflation” Per Earnings Call vs. CPI YoY Historically, the S&P 500 tends to lag during periods of high inflation. Image: BofA Global Research