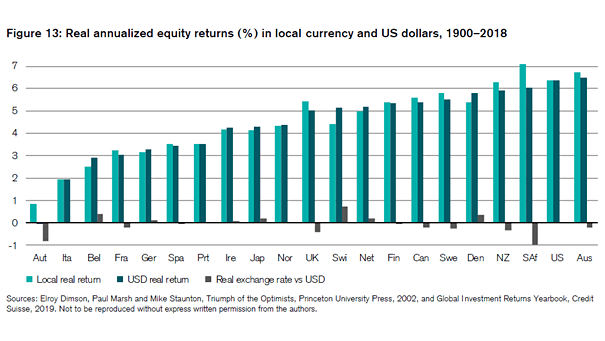

Real Annualized Equity Returns in Local Currency and U.S. Dollar

Real Annualized Equity Returns in Local Currency and U.S. Dollar Over a long period of time, this chart suggests that there is a small difference between local currency equity returns and U.S. dollar hedged returns. Image: Credit Suisse