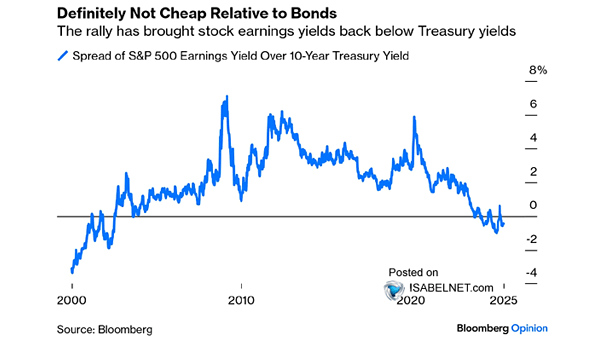

Why a Low or Negative Equity Risk Premium Coincides with a Temporary Market Peak?

Why a Low or Negative Equity Risk Premium Coincides with a Temporary Market Peak? Because it pushes investors into bonds rather than equities. This was the case in 1973, 1981, 2000, 2007 and 2018 before the market crash. The current equity risk premium is available to our subscribers. Our equity risk premium model has a great 96% correlation with…