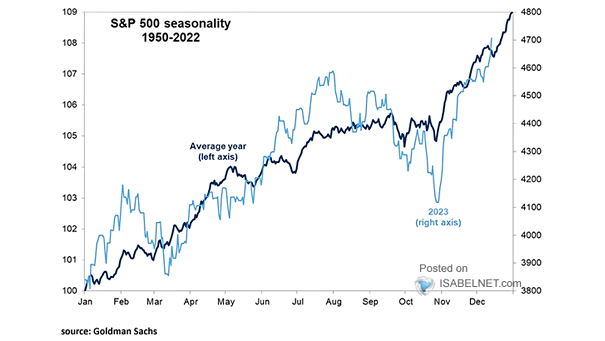

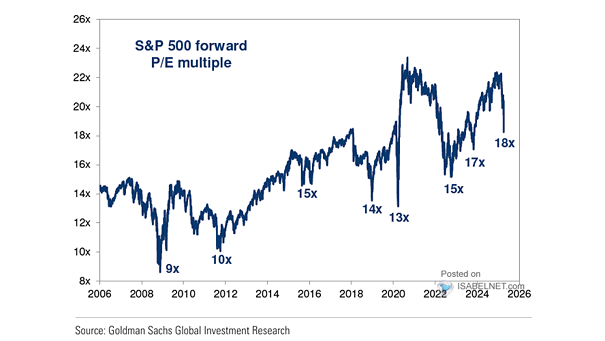

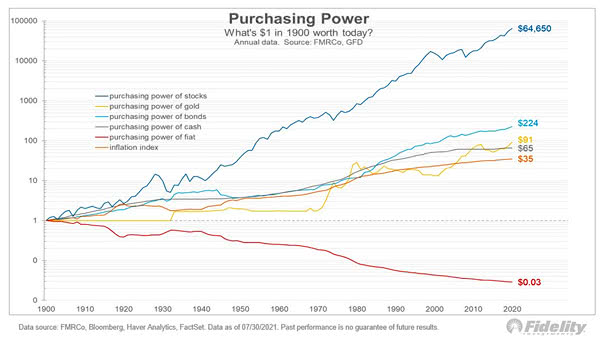

S&P 500 Seasonality

S&P 500 Seasonality While seasonality in the S&P 500 always tells a story, midterm years rank as the weakest in the four-year presidential cycle but still deliver positive returns more often than not. Image: Goldman Sachs Global Investment Research