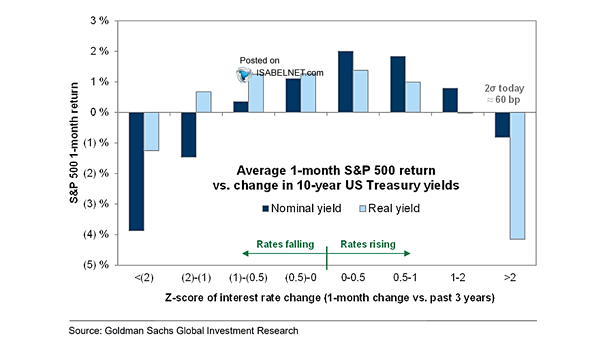

Average Global Policy Rate

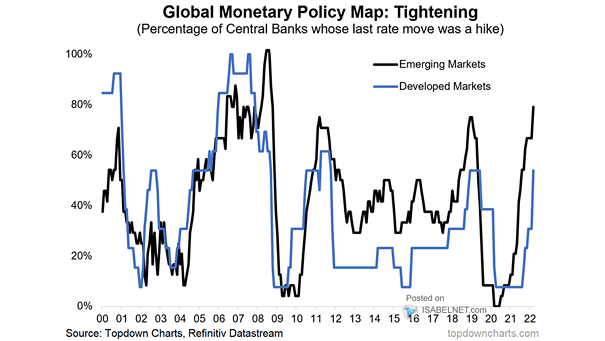

Average Global Policy Rate Global central banks moved decisively into rate‑cutting mode through 2025, with analysts expecting further, though more measured, easing in 2026, particularly in the United States. Image: Goldman Sachs Global Investment Research