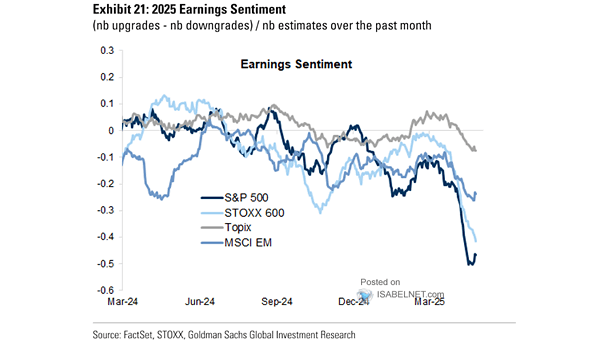

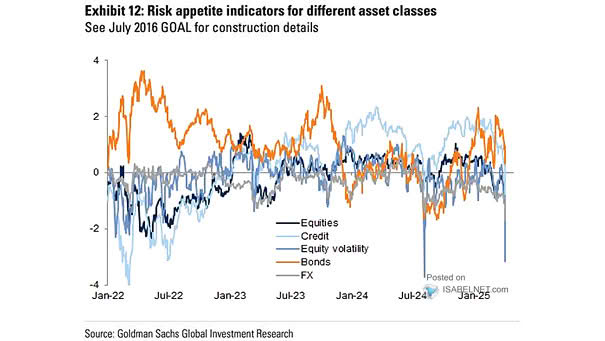

Earnings Sentiment (Analyst Upgrades Minus Downgrades Across Markets)

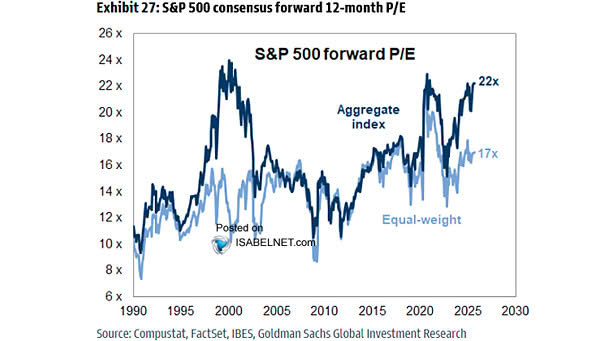

Earnings Sentiment (Analyst Upgrades Minus Downgrades Across Markets) Analysts are turning more cautious on U.S. earnings as growth concerns deepen, raising the risk of near-term pressure on stock valuations. Image: Goldman Sachs Global Investment Research