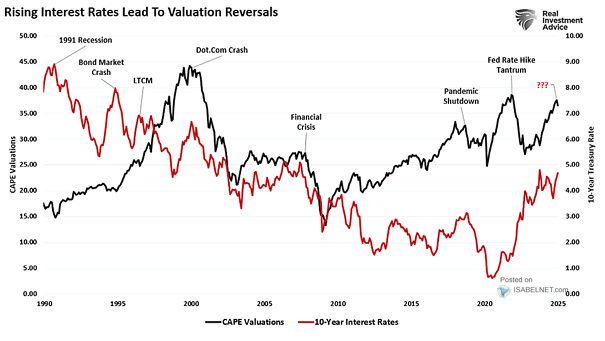

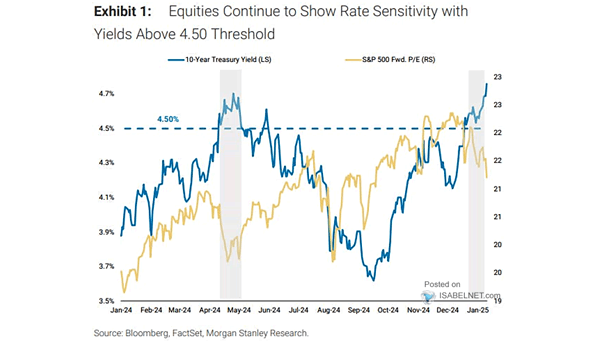

CAPE Valuations vs. 10-Year U.S. Interest Rates

CAPE Valuations vs. 10-Year U.S. Interest Rates Rising interest rates often have a significant impact on equity market valuations, frequently causing valuation reversals, especially for growth stocks and companies with high valuations based on future…