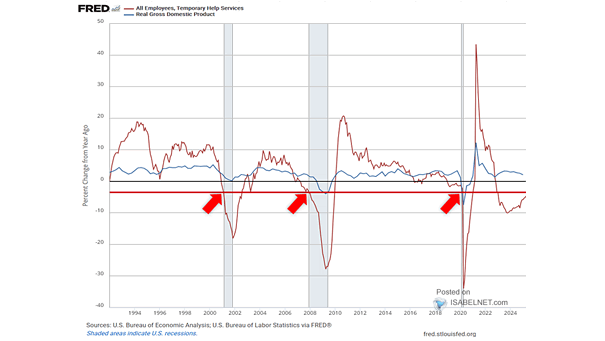

Temporary Help Services Jobs vs. Real GDP and U.S. Recessions

Temporary Help Services Jobs vs. Real GDP and U.S. Recessions Temporary Help Services Jobs stand at -3.89% YoY in December. The relationship between Temporary Help Services jobs and the macroeconomy is complex. Declines in Temporary…