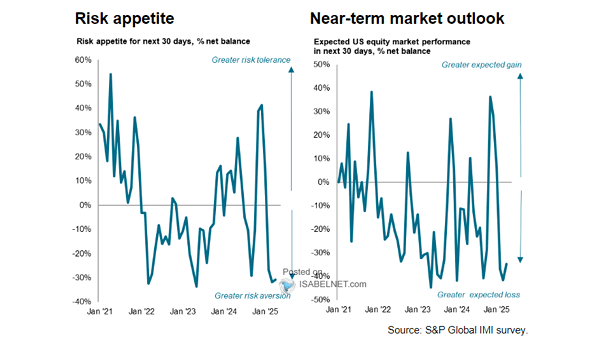

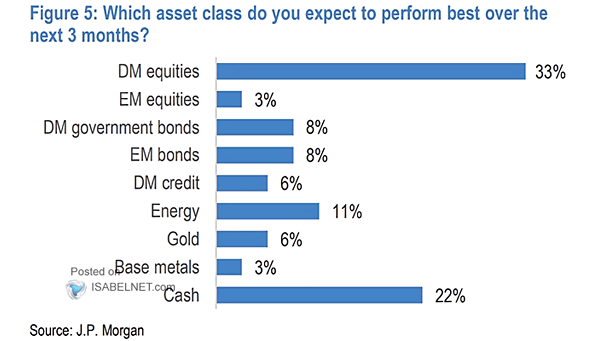

Sentiment – Risk Appetite and Expected U.S. Equity Market Performance

Sentiment – Risk Appetite and Expected U.S. Equity Market Performance With faith in the macro and policy outlook brightening, risk appetite is surging among U.S. equity fund managers, who are betting on improved market returns.…