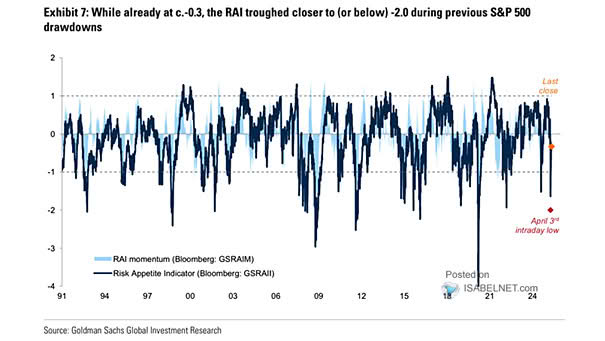

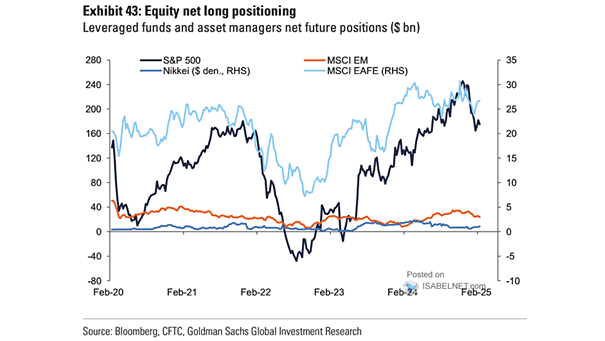

Risk Appetite Indicator Level and Momentum Factors

Risk Appetite Indicator Level and Momentum Factors Goldman Sachs’s Risk Appetite Indicator shows investors remain comfortable taking on risk, chasing steady returns with few signs of overheating. Image: Goldman Sachs Global Investment Research