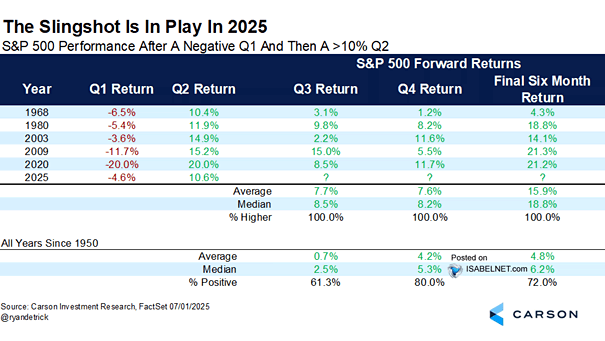

S&P 500 Performance After a Negative Q1 and Then a >10% Q2

S&P 500 Performance After a Negative Q1 and Then a >10% Q2 The 2025 market exhibits a favorable pattern: a negative Q1 followed by a strong Q2 rebound of over 10%. Historically, Q3 has consistently…