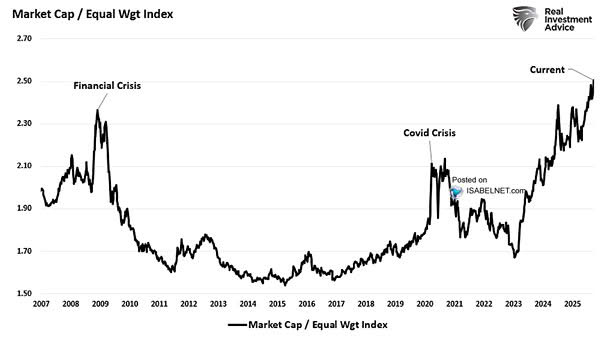

S&P 500 Market Cap Index / S&P 500 Equal Weight Index

S&P 500 Market Cap / S&P 500 Equal Weight Index The current performance gap—where the market-cap-weighted index outperforms the equal-weight index—does not necessarily signal an imminent bear market, but it does warrant some caution for…