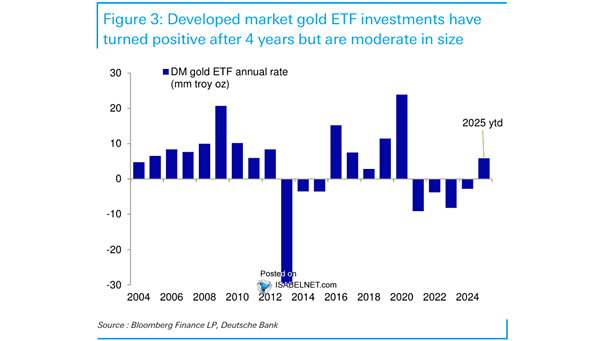

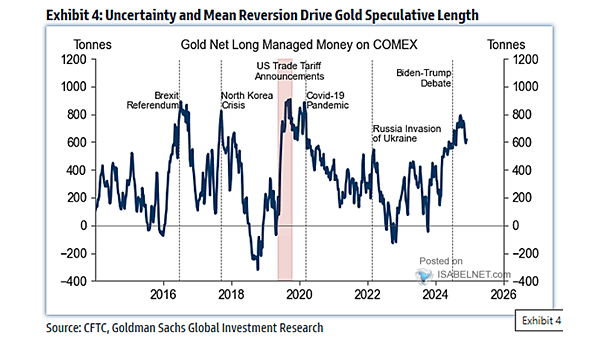

Gold ETF Holdings and COMEX Open Interest

Gold ETF Holdings and COMEX Open Interest The confluence of rising gold ETF holdings, speculative flows, central bank buying, and macroeconomic factors has created strong bullish momentum for gold, which is likely to persist through…