Why the Stock Market Valuation Matters Before a Recession?

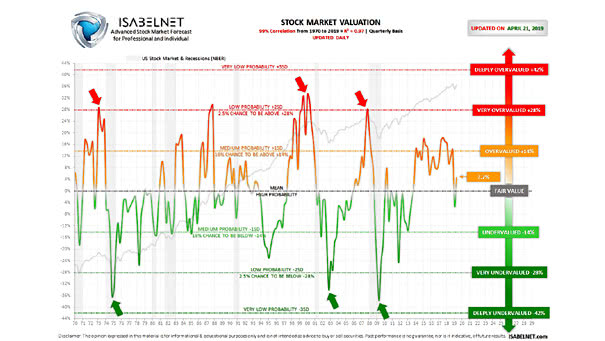

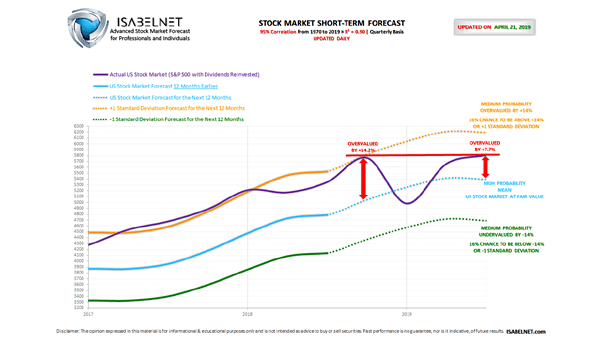

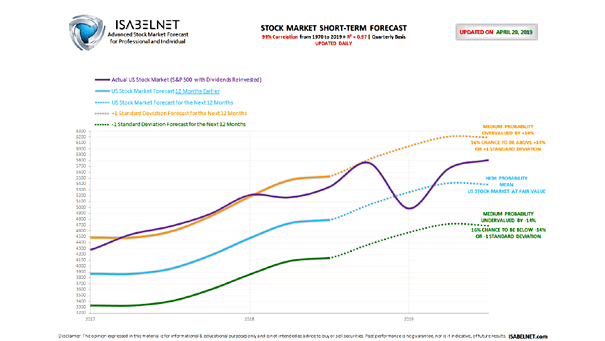

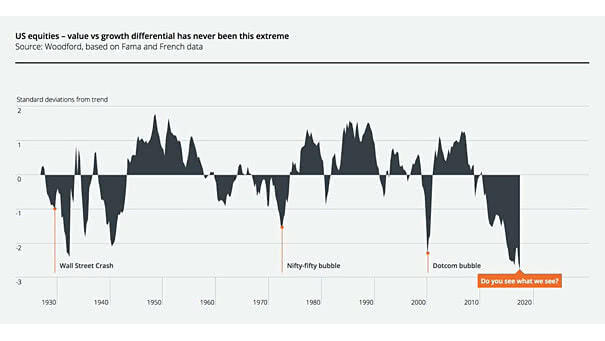

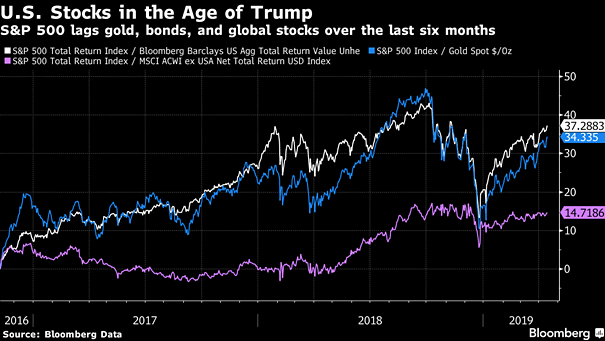

Why the Stock Market Valuation Matters Before a Recession? When the stock market is VERY overvalued before a recession, it tends to be VERY undervalued. Like the swing of a pendulum, or the stretching of…