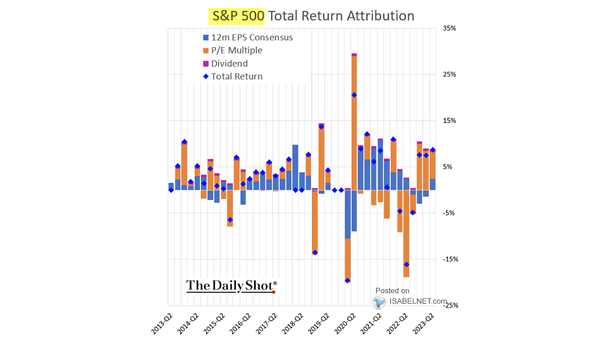

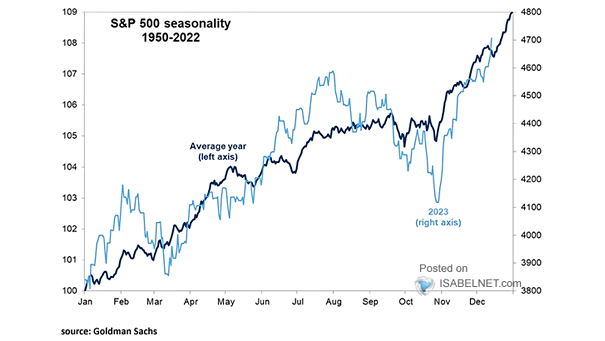

Components of S&P 500 Total Return

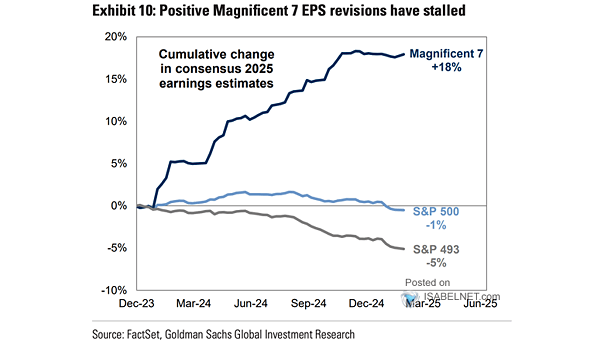

Components of S&P 500 Total Return Corporate profits carried much of the load for the S&P 500 in 2025, powering most of the index’s gains. In 2026, earnings look set to stay behind the wheel, steering another year of momentum. Image: Goldman Sachs Global Investment Research