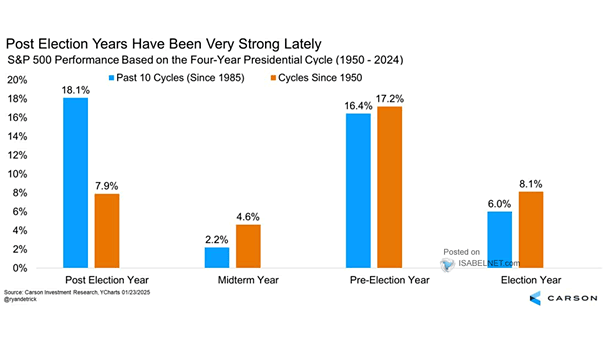

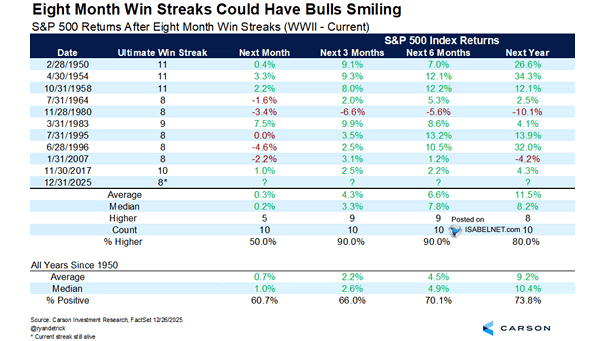

S&P 500 Index Returns Based on 4-Year Presidential Cycle

S&P 500 Index Returns Based on 4-Year Presidential Cycle Midterm election years rarely bring comfort to investors, but history still leans bullish. U.S. stocks tend to outperform in a President’s second term, as many view market dips as buying opportunities before the usual third-year rally. Image: Carson Investment Research