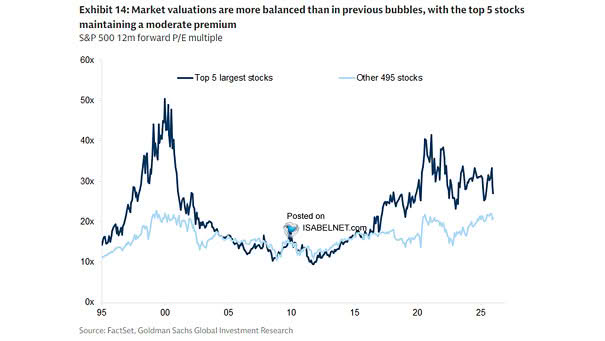

Valuations – S&P 500 12-Month Fwd P/E Multiple – Top 5 Largest Stocks vs. Other 495 Stocks

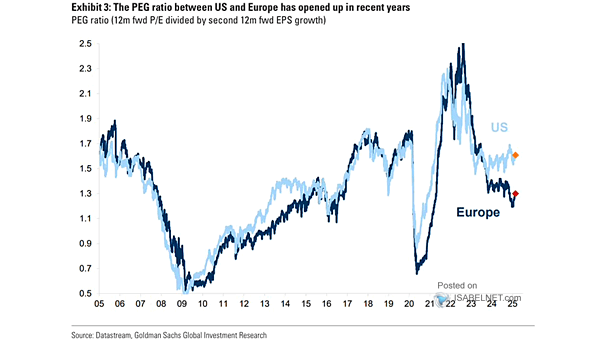

Valuations – S&P 500 12-Month Fwd P/E Multiple – Top 5 Largest Stocks vs. Other 495 Stocks Valuations aren’t as stretched as in past bubbles. The U.S. market looks more balanced, with the top five stocks trading at a moderate premium, while the rest of the market trades at valuations near their highest since 2000.…