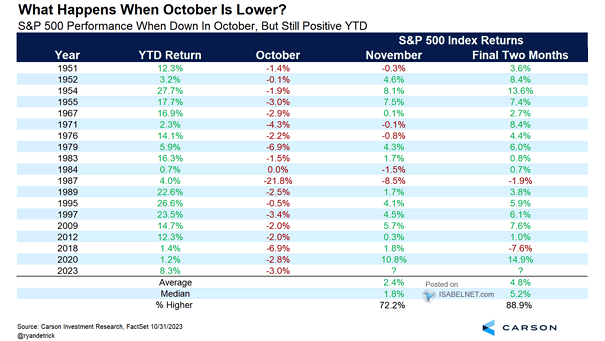

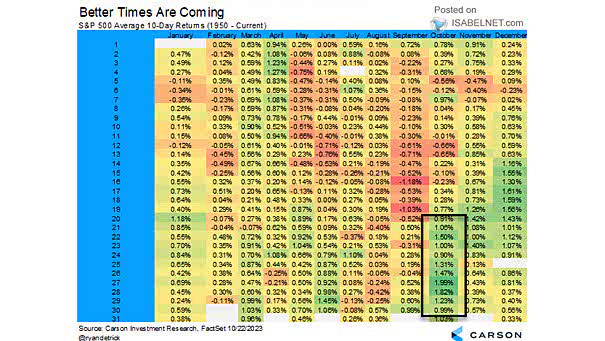

S&P 500 Performance When Down In October, But Still Positive YTD

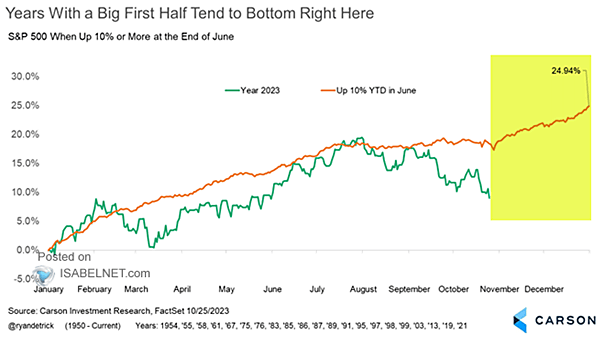

S&P 500 Performance When Down In October, But Still Positive YTD When the S&P 500 declines in October but maintains a positive performance since the beginning of the year, historical trends suggest that the last two months of the year tend to show positive returns. Image: Carson Investment Research