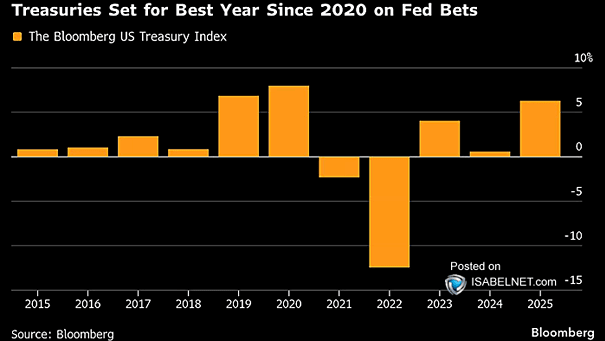

U.S. Treasury Index – Annual Return

U.S. Treasury Index – Annual Return U.S. Treasuries are on track for their strongest annual performance since 2020, lifted by Fed rate cuts and a cooling labor market that is fueling bets on more monetary easing. Image: Bloomberg