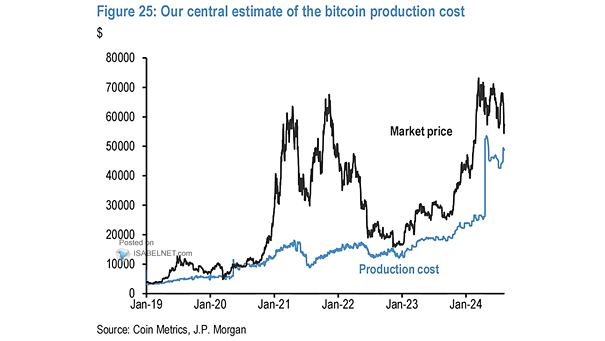

Ratio of Bitcoin to Production Cost

Ratio of Bitcoin to Production Cost Bitcoin slipped below JPMorgan’s estimated production cost of $94,000 for the first time since mid-2020, a level that has often marked the price floor in earlier cycles. Even so, the bank remains optimistic on Bitcoin’s potential. Image: J.P. Morgan