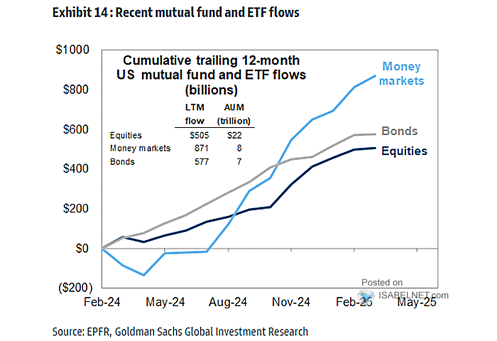

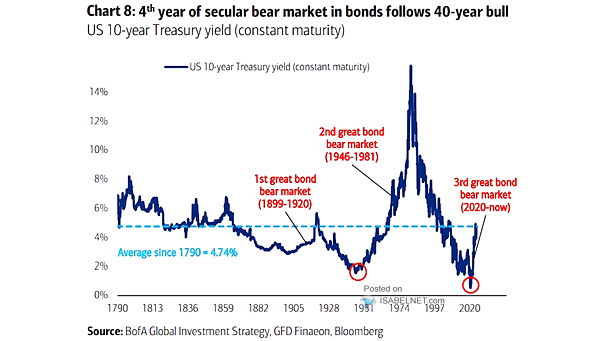

U.S. ETF and Mutual Fund Flows

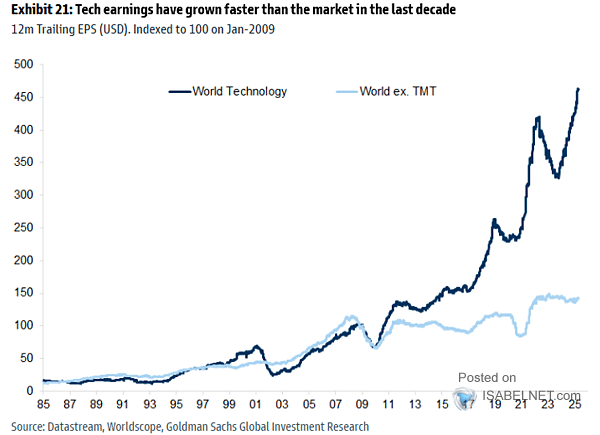

U.S. ETF and Mutual Fund Flows In 2025, many investors have been favoring the relative safety of bonds and money market funds over riskier equities, amid geopolitical tensions, and persistently high interest rates. Image: Goldman Sachs Global Investment Research