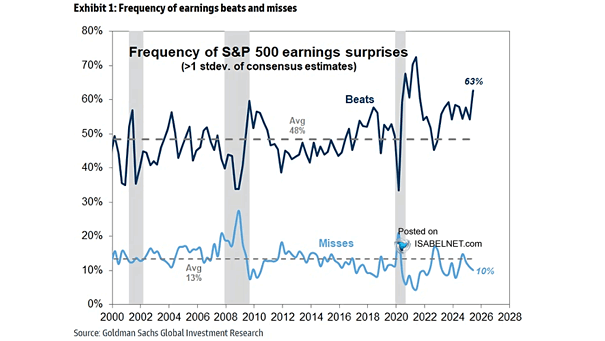

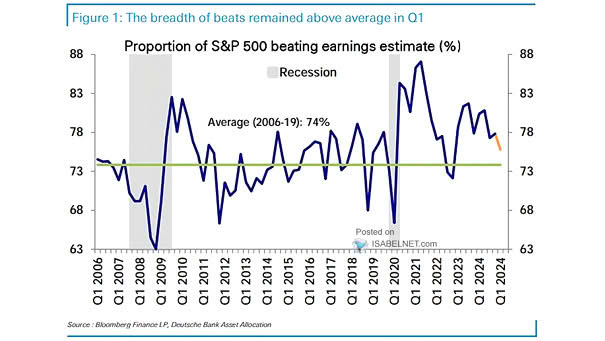

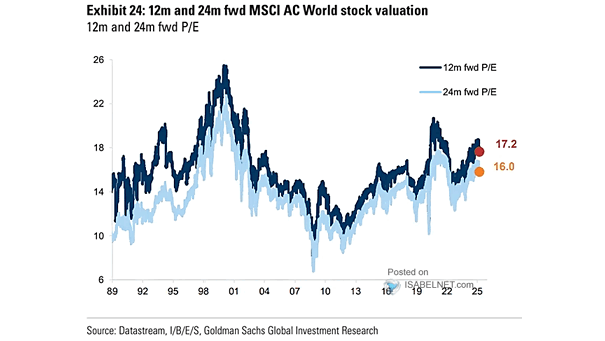

Earnings Surprises of S&P 500 Companies

Earnings Surprises of S&P 500 Companies Earnings season has made one thing clear — corporate profit strength isn’t fading yet, with 64% of S&P 500 firms smashing Q3 estimates by at least a standard deviation, while only 10% missed the mark. Image: Goldman Sachs Global Investment Research