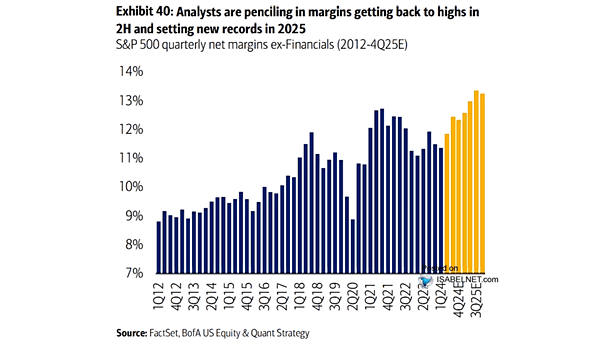

S&P 500 Trailing 4-Quarter Net Profit Margin (Ex. Financials)

S&P 500 Trailing 4-Quarter Net Profit Margin (Ex. Financials) Over the past 35 years, the S&P 500’s profit margin has climbed from 5% to 12% and has held at high levels in recent years, with forecasts pointing to continued growth in 2026 and 2027. Image: Goldman Sachs Global Investment Research