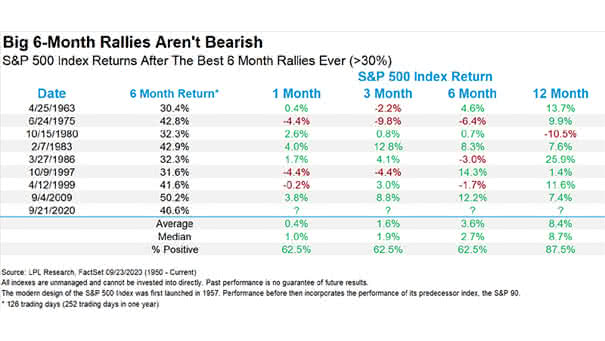

S&P 500 Performance After 30% Rallies in Five Months

S&P 500 Performance After 30% Rallies in Five Months A rally of over 30% in just five months is an exceptionally rare occurrence for the S&P 500, having happened only five times since 1950. In every case, the index was higher one year later, with average gains exceeding 18%. Image: Carson Investment Research