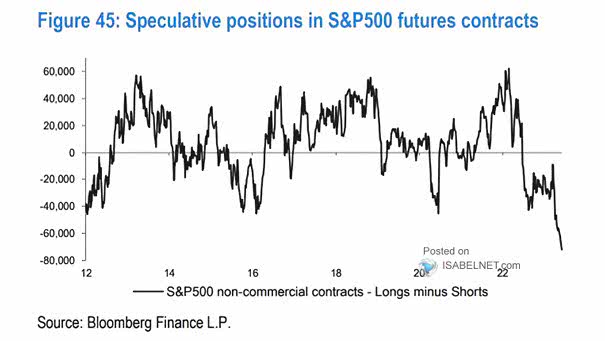

S&P 500 and Speculators’ Net Positioning

S&P 500 and Speculators’ Net Positioning Speculators have turned increasingly bearish, slashing their net long positions in major U.S. equity index futures—E-mini S&P 500, Nasdaq, Dow Jones, S&P Midcap, and Russell 2000—to levels not seen since late 2023. Image: Bloomberg