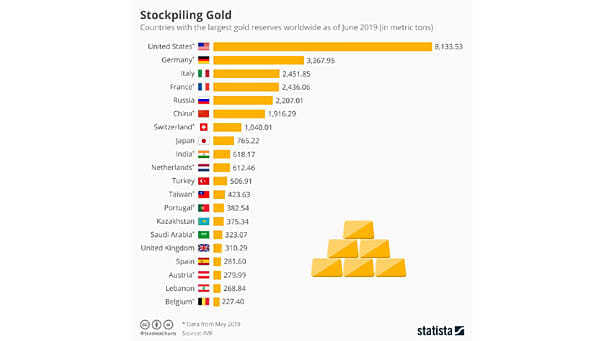

Gold Expanding Share of Global Foreign Exchange + Gold Reserve Holdings

Gold Expanding Share of Global Foreign Exchange + Gold Reserve Holdings With gold now making up 30% of global foreign exchange and gold reserves, the metal is stealing back the spotlight—a clear sign of how fragile faith in fiat has become. Image: Deutsche Bank